When unexpected events occur, navigating the insurance claims process can seem daunting. This comprehensive guide offers a clear roadmap to help you smoothly submit your claim and acquire the settlement you deserve. First, it's essential to carefully review your policy documents to understand the specific coverage provided and any possible exclusions.

- Subsequently, contact your insurance company as soon as possible to report them of the incident. Be prepared to supply detailed information about the event, including the date, time, location, and a concise summary of what occurred.

- Moreover, collect all relevant documents such as photographs, police reports, medical records, and repair estimates. These items will support your claim and speed up the claims process.

- Throughout process, maintain clear and consistent communication with your insurance adjuster. Timely respond to any requests for data and retain accurate records of all engagements.

Bear in mind that the claims process can sometimes take time. Remain calm and adhere to your insurance company's guidelines. If you encounter any difficulties or have concerns, don't hesitate to request assistance from a licensed insurance broker or attorney.

Deciphering Insurance Fraud: Regular Cons and Unveiling Techniques

Insurance scam is a serious problem that can have significant reputational consequences. Fraudsters employ a variety of ingenious tactics to unlawfully obtain benefits. Common deceptions include staged accidents, inflated claims, and identity {theft|. Some dishonest activities may even involve altered documents or false testimonies.

To combat this ubiquitous problem, insurance companies and law enforcement agencies have implemented advanced identification methods. These include scrutinizing data for inconsistencies, performing in-depth checks on claimants, and leveraging technology to detect fraudulent patterns. Cooperation between insurers, law enforcement, and regulatory bodies is also crucial in combating insurance fraud effectively.

Safeguarding Your Home and Belongings: Fire Insurance Coverage

Fire is one of the most destructive forces that can impact your home. A single spark can quickly intensify into a devastating blaze, leaving behind untold damage to your assets. This makes why fire insurance coverage plays as an essential aspect of any comprehensive homeowner's policy.

A robust fire insurance policy will deliver financial protection to help you recover your home and replace your effects. It can also cover the cost of temporary accommodation if your home is rendered unsuitable.

Understanding the terms of your fire insurance policy remains crucial. This get more info includes knowing your policy limits, as well as any exclusions that may apply. By thoroughly reviewing your policy and discussing your insurance agent, you can ensure that you have the suitable coverage to protect yourself and your property from the devastating consequences of a fire.

{The Impact of Insurance Fraud on Premiums for All|Insurance Fraud's Effect on Premium Costs|Impact of Fraudulent Insurance Claims

Insurance fraud perpetrates a significant burden on the insurance industry, ultimately resulting in higher premiums for honest policyholders. When individuals engage in fraudulent activities, such as fabricating injuries or stating fictitious losses, insurance companies must absorb these costs. To mitigate these expenses, insurers often hike premiums across the board, burdening everyone who purchases insurance. This injustifiably disciplines honest policyholders who therefore contribute to the system's stability.

- Mitigating insurance fraud is crucial for securing a fair and sustainable insurance market.

Understanding Fire Damage and Its Implications for Insurance Claims

Fire damage can ravage a property in an instant, leaving behind significant physical and emotional harm. Determining the extent of fire damage is crucial for homeowners to understand their obligations when filing an insurance claim. The magnitude of the fire, along with factors like construction materials and the presence of smoke and water damage, greatly influence the overall cost of repairs. Insurance policies typically define coverage for fire damage, but it's essential to review your policy carefully to understand the restrictions that may apply.

It's important to capture all damage with photos and videos as soon as it is safe to do so. This evidence can be vital in supporting your insurance claim. Reaching out your insurance company promptly after a fire is essential to initiate the claims process. They will assign an adjuster to evaluate the damage and determine the degree of coverage.

Navigating Insurance Claims Disputes: Options and Strategies

When conflicts arise during the insurance claims process, it can be challenging. Thankfully, there are several options available to resolve these disagreements in a just manner.

One common approach is negotiation, where the involved parties strive to come to an settlement on their own. Another option is mediation, which involves engaging a objective facilitator to help facilitate the talks. In more complex cases, arbitration may be considered, where a designated arbitrator reviews the evidence and renders a legally enforceable judgment.

Furthermore, it's crucial to understand your legal protections throughout the settlement negotiation process.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Matilda Ledger Then & Now!

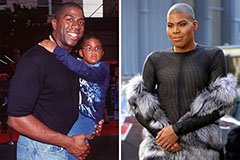

Matilda Ledger Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!